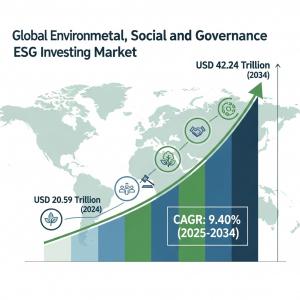

Environmental Social Governance Investing Market Size to Reach USD 42.24 Trillion by 2034, Growing at 9.40% CAGR

Environmental social governance investing market size was worth around USD 20.59 trillion in 2024 and is predicted to grow to around USD 42.24 trillion by 2034

Environmental social governance investing market size was worth around USD 20.59 trillion in 2024 and is predicted to grow to around USD 42.24 trillion by 2034, (CAGR) of 9.40% between 2025 and 2034.”

PUNE, MAHARASHTRA, INDIA, September 22, 2025 /EINPresswire.com/ -- The global Environmental, Social, and Governance (ESG) investing market Size is witnessing unprecedented growth as investors increasingly prioritize sustainability, ethical practices, and long-term value creation. Valued at USD 20.59 trillion in 2024, the market is projected to reach USD 42.24 trillion by 2034, registering a compound annual growth rate (CAGR) of 9.40% between 2025 and 2034.— Deepak Rupnar

Access key findings and insights from our Report in this Free sample -https://www.zionmarketresearch.com/sample/environmental-social-governance-investing-market

ESG investing integrates environmental, social, and governance factors into investment decisions, encouraging companies to adopt sustainable practices while offering investors financial returns aligned with ethical and social objectives.

Key Insights:

As per the analysis shared by our research analyst, the global environmental social governance investing market is estimated to grow annually at a CAGR of around 9.40% over the forecast period (2025-2034)

In terms of revenue, the global environmental social governance investing market size was valued at around USD 20.59 trillion in 2024 and is projected to reach USD 42.24 trillion by 2034.

The environmental, social, and governance (ESG) investing market is projected to grow significantly due to increasing investor preference for impact-driven and ethical portfolios, the integration of ESG factors into corporate governance architecture, and enhanced reporting standards and transparency requirements.

Based on type, the ESG integration segment is expected to lead the market, while the sustainable funds segment is expected to grow considerably.

Based on investor types, the institutional investors segment is the dominating segment, while the retail investors segment is projected to witness sizeable revenue over the forecast period.

Based on the application, the integrated ESG segment is expected to lead the market compared to the environmental segment.

Based on region, Europe is projected to dominate the global market during the estimated period, followed by North America.

Key Market Drivers

Growing Awareness of Climate Change: Investors increasingly prefer companies with low carbon footprints and sustainable resource management.

Regulatory Support & Reporting Standards: Policies and frameworks such as the EU Sustainable Finance Disclosure Regulation (SFDR) and SEC ESG disclosure requirements are boosting adoption.

Investor Demand for Responsible Investing: Millennials and institutional investors are prioritizing ESG-compliant portfolios.

Corporate Sustainability Initiatives: Businesses are aligning with ESG principles, attracting ESG-focused capital.

Risk Mitigation: ESG investments are seen as a hedge against reputational, environmental, and regulatory risks.

Do You Have Any Query Or Specific Requirement? Request Customization of Report:https://www.zionmarketresearch.com/custom/9775

Market Segmentation

By Investment Type

Equity ESG Funds: Investments in stocks of companies meeting ESG criteria.

Fixed-Income ESG Funds: Bonds and debt instruments with ESG compliance.

Mixed/Hybrid ESG Funds: Combination of equity and debt investments adhering to ESG principles.

Exchange-Traded Funds (ETFs): ESG-focused ETFs providing diversified exposure.

Private Equity & Venture Capital: ESG-integrated investment in private companies.

By Sector

Energy & Utilities: Investments in renewable energy, low-carbon power, and energy-efficient technologies.

Technology & Communication: Companies with strong data privacy, labor practices, and sustainability initiatives.

Healthcare & Life Sciences: Firms focusing on equitable access, ethical practices, and sustainable operations.

Consumer Goods & Retail: ESG-driven supply chains, sustainable sourcing, and waste reduction practices.

Financial Services: Banks and insurers integrating ESG into lending and underwriting.

Industrial & Manufacturing: Companies reducing emissions, adopting circular economy practices, and ensuring worker safety.

By Investor Type

Institutional Investors: Pension funds, sovereign wealth funds, and insurance companies leading ESG adoption.

Retail Investors: Individual investors seeking ethical and responsible portfolios.

Family Offices & Private Wealth: Focus on intergenerational sustainability and impact investing.

Regional Insights

North America:

North America dominates the ESG investing market, driven by regulatory frameworks, institutional investor adoption, and a strong culture of responsible investing. The U.S. leads global ESG assets under management (AUM).

Europe:

Europe is a major hub for ESG investing due to strict EU regulations, sustainable finance policies, and proactive ESG disclosure requirements. Countries like Germany, France, and the UK are at the forefront.

Asia-Pacific (APAC):

APAC is the fastest-growing region as governments, financial institutions, and corporations increasingly embrace ESG principles. China, Japan, India, and Australia are key contributors.

Latin America:

Latin America’s ESG market is growing steadily, driven by renewable energy projects and sustainable agriculture initiatives, especially in Brazil, Mexico, and Chile.

Middle East & Africa (MEA):

MEA’s ESG adoption is gaining traction with sovereign wealth funds, oil & gas diversification initiatives, and green finance projects in countries like UAE, Saudi Arabia, and South Africa.

Key Market Trends

Integration of AI & Big Data in ESG Analysis: For accurate risk assessment, ESG scoring, and impact measurement.

Green Bonds & Sustainable Finance Instruments: Driving ESG-compliant fixed-income investments.

Impact Investing: Focus on measurable social and environmental outcomes along with financial returns.

Corporate ESG Reporting: Increasing transparency and standardized metrics attract investor confidence.

ESG-Themed ETFs & Index Funds: Popular among retail and institutional investors for diversified exposure.

Inquiry For Buying- https://www.zionmarketresearch.com/inquiry/environmental-social-governance-investing-market

Competitive Landscape & Major Key Players

The global ESG investing market is highly competitive, with asset managers, banks, and fintech firms offering ESG-aligned investment products. Key players focus on portfolio customization, ESG analytics, and sustainable finance advisory services.

Major Key Players Include:

BlackRock, Inc. – Offers ESG ETFs, mutual funds, and advisory solutions globally.

Vanguard Group, Inc. – ESG-integrated index funds and sustainable investment options.

State Street Global Advisors – ESG ETFs and responsible investment portfolios.

Fidelity Investments – Active ESG mutual funds and sustainable asset management.

BNP Paribas Asset Management – ESG-compliant investment solutions in Europe and globally.

Amundi Asset Management – Leader in sustainable and impact investing in Europe.

Goldman Sachs Asset Management – ESG advisory and sustainable finance solutions.

JPMorgan Chase & Co. – ESG investment products for institutional and retail clients.

RobecoSAM – Specialized ESG data and sustainability-focused investment products.

MSCI Inc. & Sustainalytics – ESG ratings, analytics, and benchmarks supporting investment decisions.

Future Outlook (2025–2034)

ESG investing is expected to more than double in size, from USD 20.59 trillion to USD 42.24 trillion, reflecting strong investor demand for sustainable, responsible portfolios.

Growing focus on climate transition investments, renewable energy financing, and social impact projects.

Increased adoption of digital platforms and AI-driven ESG analytics for better portfolio management.

Expansion of ESG products in emerging markets such as APAC, Latin America, and MEA.

Corporations increasingly align with net-zero and sustainability goals, attracting ESG capital.

Challenges

Lack of Standardization: Differences in ESG scoring, ratings, and reporting metrics.

Greenwashing Risks: Misrepresentation of ESG compliance by companies can reduce investor confidence.

Regulatory Complexity: Diverse ESG frameworks across regions.

Data Availability & Quality: Accurate and transparent ESG data remains a challenge, particularly in emerging markets.

Conclusion

The global ESG investing market is projected to grow from USD 20.59 trillion in 2024 to USD 42.24 trillion by 2034, at a CAGR of 9.40%. Rising awareness of environmental, social, and governance factors, regulatory support, and investor preference for sustainable finance are key growth drivers. Firms integrating ESG principles effectively and offering transparent, measurable investment solutions are poised to capture a significant share of this rapidly expanding market.

More Trending Reports by Zion Market Research -

Forensic Technologies Market By Service Type (DNA Profiling, Chemical Analysis, Biometric/ Fingerprint Analysis, Firearm Analysis And Others), By Application (Pharmacogenetics, Biodefense And Biosurveillance, Judicial/Law Enforcement And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032-https://www.zionmarketresearch.com/report/forensic-technologies-market

Batten Disease Treatment Market by Disease Type (Infantile, Late Infantile, Juvenile and Adult) and by Therapy Type includes Occupational Therapy and Physical Therapy: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-https://www.zionmarketresearch.com/report/batten-disease-treatment-market

Monoclonal Antibody Therapeutics Market By Application(Cancer, Autoimmune Diseases, Infection, Hematological Diseases, Others), By Source(Human, Humanized, Chimeric, Others), By End User(Hospitals, Private Clinics, Research Institute), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032-https://www.zionmarketresearch.com/report/monoclonal-antibody-therapeutics-market

Equine Healthcare Market Analysis By Product (Drugs, Vaccines and Supplemental Feed Additives) By Disease (West Nile Virus, Equine Rabies, Equine Influenza, Equine Herpes Virus, Potomac Horse Fever and Others), By Distribution Channel (Veterinary Hospitals and Clinics, Retail Pharmacies and Drug Stores and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032-https://www.zionmarketresearch.com/report/equine-healthcare-market

Nutraceutical Excipients Market By Type (Fillers & Diluents, Binders, Coating Agents, Disintegrants, Lubricants, and Flavoring Agents), by Application (Prebiotics, Probiotics, Amino Acids & Proteins, Minerals, Vitamins, and Omega-3 Fatty Acids), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032-https://www.zionmarketresearch.com/report/nutraceutical-excipients-market

Ovarian Cancer Market Analysis By Type(Epithelial Ovarian Tumors, Ovarian Germ Cell Tumors, Ovarian Stromal Tumors, and Primary Peritoneal Carcinoma), By Cancer Stage(Stage I, Stage II, Stage III, and Stage IV), By Diagnostics (Physical Examination, Biopsy, Blood Tests, Human Chorionic Gonadotropin (hCG) test, ultrasound, MRI, PET, and CT scans), and By Treatment (Chemotherapy, Targeted Therapy, Radiation Therapy, Immunotherapy, Hormonal Therapy, and Surgery), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast 2024-2032-https://www.zionmarketresearch.com/report/ovarian-cancer-market

Hemophilia Treatment Drugs Market By Product Type (Recombinant Coagulation Factor Concentrates, Plasma Derived Coagulation Factor Concentrates, Desmopressin, And Antifibrinolytic Agents), By Disease Type (Hemophilia A, Hemophilia B, And Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, And E-Commerce), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032-https://www.zionmarketresearch.com/report/hemophilia-treatment-drugs-market

Myelofibrosis Treatment Market By Diagnosis Type (Gene Mutation Analysis, Bone Marrow Biopsy, Imaging Test, And Blood Tests), By Treatment Type (Chemotherapy, Blood Transfusions, Stem Cell Transplant, Splenectomy, Radiation Therapy, And Others), By Drug Type (Hydroxyurea, Immunomodulators, JAK Inhibitor, And Others), By End-User (Hospitals, Clinics, And Bone Marrow Transplant Centers), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032-https://www.zionmarketresearch.com/report/myelofibrosis-treatment-market

Oncology Biosimilar Market By Cancer Type (Breast Cancer, Colorectal Cancer, Blood Cancer, Neutropenia Cancer, Non-Small Cell Lung Cancer, And Others), By Drug Type (MAb, Immunomodulators, Hematopoietic Agents, G-CSF, And Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacy, And Online Pharmacy), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032-https://www.zionmarketresearch.com/report/oncology-biosimilar-market

Macrolide Drugs Market by Drug Type (14-membered ring agents, 14-membered ring agents, 15-membered ring agents (Azalides), 16-membered ring agents, and Ketolides), By Distribution Channels (Hospital pharmacies, Clinics, Hospitals, Retail pharmacies, and Online pharmacies): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-https://www.zionmarketresearch.com/report/macrolide-drugs-market

Deepak Rupnar

Zion Market Research

+1 855-465-4651

richard@zionmarketresearch.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.